As a research team, we’ve spent over five years conducting qualitative research in various industries, with a strong focus on financial services. One of the most interesting aspects of what we do is seeing trends emerge at scale over time.

This led to us host our first webinar at How Might We. The webinar explored trust as a major theme in financial services over the past 5 years.

This blog post summarises what we found at a high level and touches on how your organisation can be more strategic about identifying ways to build trust.

What are trust factors?

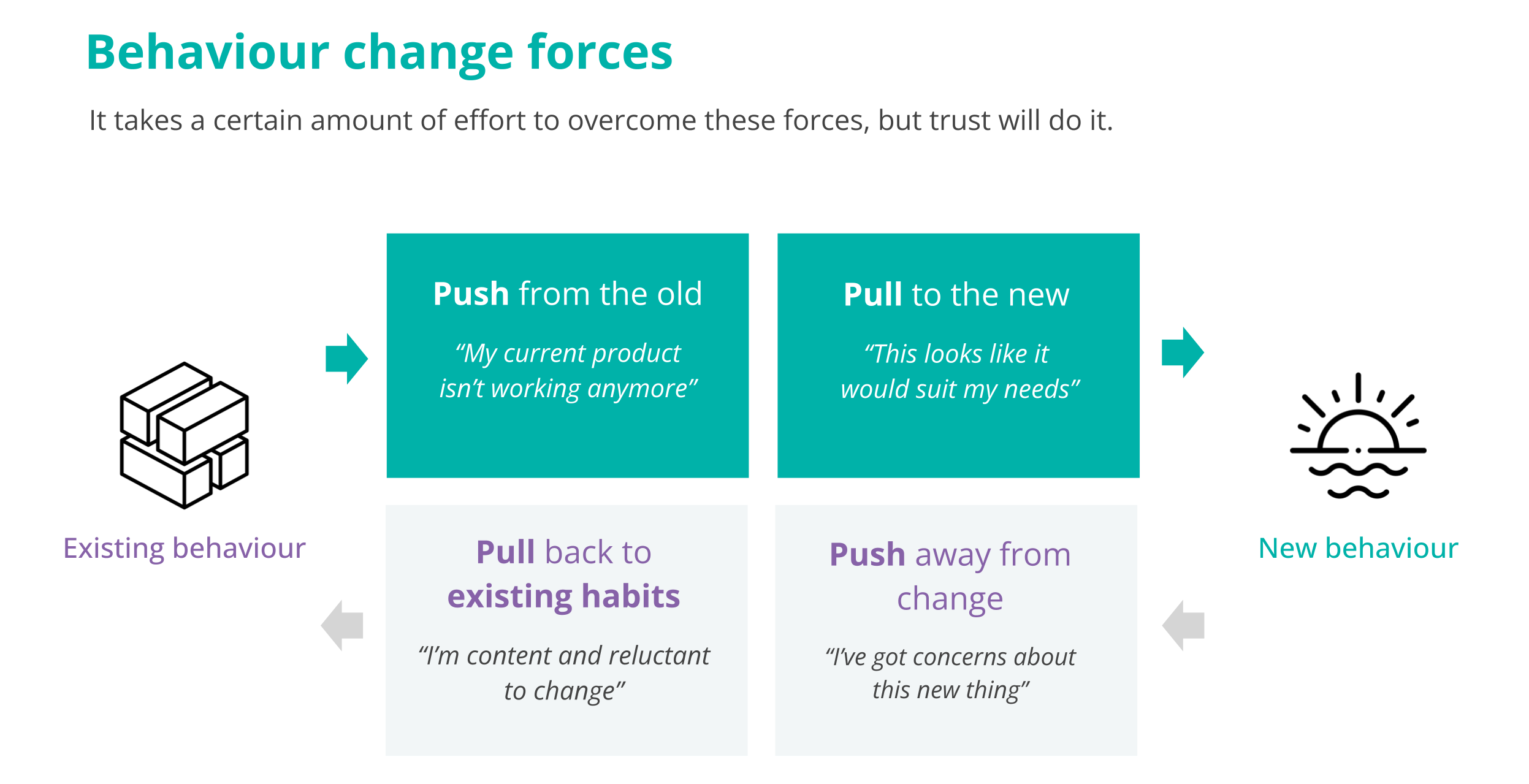

As researchers, we spend a lot of time analysing behavioural trends to uncover patterns that trigger behaviour changes.

Interestingly, trust has been consistently present within the forces that trigger behaviour change. It has emerged as a hugely influential aspect of decision-making in financial services. When trust is present, customers are more likely to engage, remain loyal, and recommend the product or service to others.

How did we quantify trust?

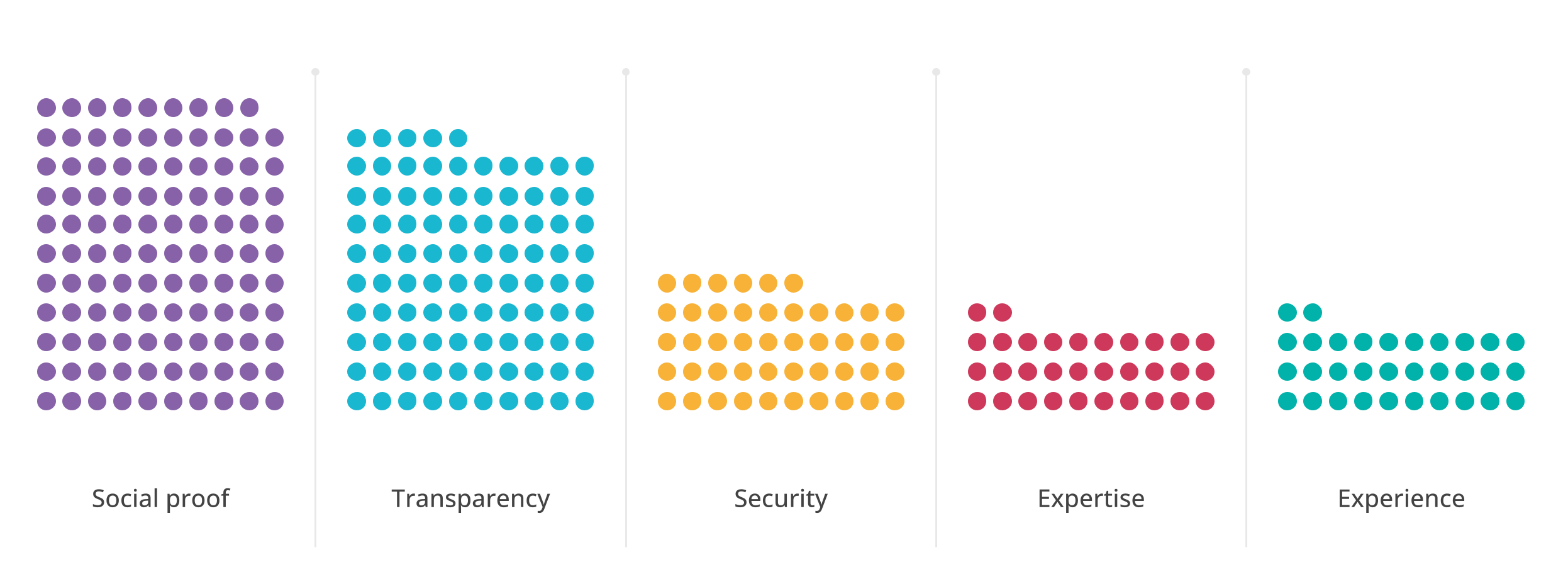

These insights aren’t just theoretical; they’re based on hundreds of hours of qualitative interviews with consumers.

What makes it particularly difficult to quantify is that the research is heavily influenced by our objectives for each research study; and who we have recruited. We look forward to conducting a dedicated study around trust in the future (watch this space!). But for now, we identified trust factors that have come up most frequently in our interviews.

We then grouped them into key themes and compared the volume of insights we saw for each factor.

What were the results?

We’ve identified the following trust factors as the most impactful in financial services:

Social Proof

Customers are more likely to trust brands with visible endorsements, positive reviews, and testimonials from people they know. Social proof remains one of the most powerful trust factors. The general sentiment is, “People I know aren’t trying to sell me something, so they must be more reliable than marketing.” This trust factor has become so impactful that it feeds into many of the others.

Transparency and Clarity

We have observed this to be the biggest blocker in usability tests. Customers become too skeptical to continue when information is not digestible, or not available at all. The biggest stumbling block organisations trip over here is to focus on the business selling point rather than understanding the information that is most relevant to customers.

Security and Privacy

SABRIC’s 2022 annual crime statistics is just one indicator of the surge in digital crime in the financial sector over the past few years. Customers feel it and have developed a heightened sense of caution around online scams. They look for indicators to know that an organisation is legit, which can feed back into social proof.

Expertise and Experience

Trust grows when customers have consistent experiences. They expect brands to:

- Establish and maintain relationships (particularly for business customers).

- Create consistently positive experiences

- Handle matters seamlessly when things do go wrong

Customers are also more likely to stay with a brand they are content with rather than risking an experience with a brand they don’t know. Social proof is particularly effective at overcoming this force (or lack thereof).

How can your organisation be more strategic when it comes to building trust?

There are some basic best practices that brands may follow but these can only take you so far. Even quantitative survey research may help you understand what customers think but may not tell you why. We recommend taking a more qualitative approach.

Usability tests can help identify gaps in the value proposition. Identifying the information that is most important to customers will help you overcome the biggest roadblock in your product discovery.

In-depth interviews can shed more light on sentiment. Understanding the why can help you identify actionable areas for improvement.

Ultimately, the only way to truly understand where your organisation sits on the trust scale, is to engage with your customers through research.